The government’s decision to withdraw notes of Rs 500 and Rs 1,000 was intended to attack the black economy. A natural corollary to this was a likely hit to the real sector, which, for long, has been considered a refuge for unaccounted money. The trends so far suggest some immediate hit to deals but clarity on price trends is yet to emerge.

Residential sales’ enquiries have witnessed a drop and prices in the secondary markets are softening, says a report ‘A Review of 2016 and Peering into 2017’ by real estate consultancy firm Jones Lang LaSalle India.

After this move, transactions in real estate have virtually dried up, particularly in the land and capital raising business. Residential sales’ enquiries have witnessed a drop, and prices in secondary markets are softening.

Jones Lang LaSalle India

While industry-wide data is not available, an indication of the extent of drop in transactions can be gleaned from the registration data reported by state governments.

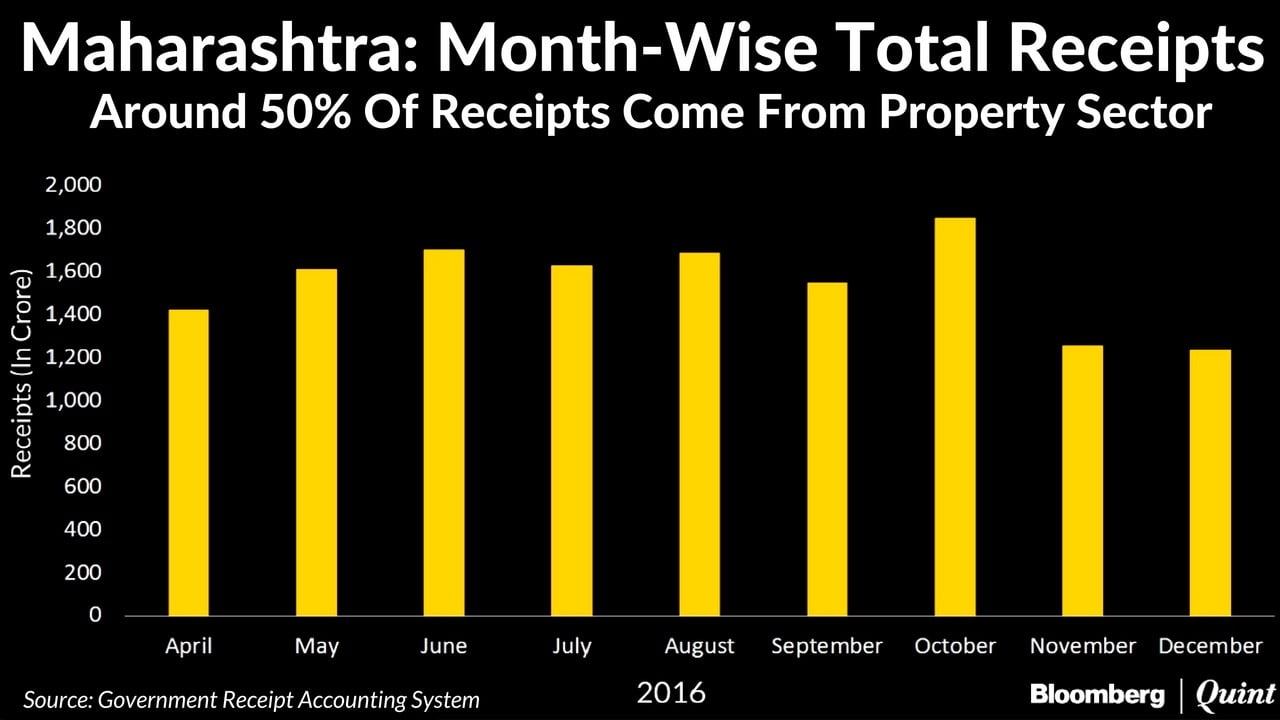

In Maharashtra, for instance, receipts reported by the Inspector General of Registration (chart below) fell from a high of Rs 1,846.61 crore in October to Rs 1,255.89 crore in November and stood at Rs 1,227.35 crore in December until the 26th of the month. Roughly 50 percent of receipts come from the property sector.

A caveat worth mentioning here is that October registrations were the highest seen so far this fiscal year.

“The sales have slowed down in both primary as well as secondary market and registrar’s data reflects that,” Ashutosh Limaye, head of research and real estate intelligence service at JLL India told BloombergQuint.

While the initial impact of demonetisation was felt across both the primary and the secondary segments of the real estate market, a slow revival in the former is being seen in December.

“It is slowly picking up this month,” N Ramaswamy, Inspector General of Registrations and Controller of stamps in Maharashtra told BloombergQuint over the phone.

Post demonetisation, registrations fell about 38 percent in the month of November but in the current month, the situation seems to be slightly improving, he added without sharing the exact data for December.

Those tracking the sector share that view and expect the primary market to stabilize faster than the secondary markets. “Buyers have slowly started to come back,” said Limaye while adding that many sellers in the secondary market have withdrawn.

Jaxay Shah, president-elect for the Confederation of Real Estate Developers Associations’ of India, told BloombergQuint that the secondary market has come to a virtual standstill.

The primary market in comparison to the secondary market has been stable because the transactions are through financial institutions and banks. The secondary market, on the other hand, has come to a virtual standstill and, with further policy changes such as RERA (Real Estate Regulatory Authority), will have to undergo a complete overhaul in how they conduct their business so as to ensure functioning in the months.

Jaxay Shah, President-Elect, CREDAI

Samantak Das, chief economist and national director at Knight Frank India, however, is not convinced that the real estate sector will see a quick recovery

“We see no traction coming back in the market to be honest. In the fourth quarter, the launches, sales (have come to) an absolutely grinding halt,” he told BloombergQuint.

Shaking The Equilibrium

According to the JLL report quoted above, during the first three quarters of 2016, the number of units sold was higher than the project launches in the same period, which would have helped correct the problem of over-supply in the sector.

But demonetization could drastically impair the readings in the fourth quarter, said the report.

The positive trend, which was seen in three quarters, have been wiped off because of demonetisation, said Das. “Yes, demonetisation has played havoc.”

Just like in the case of the broader economy, how long the pain will last is anybody’s guess.

“I don’t know how long this will last. The Prime Minster said it will get over by December 30. But obviously, it will take more,” said Niranjan Hiranandani, co-founder of the Hiranandani Group.

Will Property Prices Fall?

The positive fallout of demonetisation for buyers could be a fall in prices but there are no clear indications yet on how quickly and how much prices will fall by.

“The rates have not gone down anywhere except for NCR (National Capital Region), where a rate correction was always on the cards and it happened,” Limaye said.

Developers and consumers are still trying to read the situation and the actual manifestation of demonetisation will probably come in two to three months, Das added. “It is too early to get clarity on the situation. Even the government of India is not very clear about the impact.”

For now, low availability of cash and uncertainty about price trends is likely to keep the real estate market subdued.

“It is a psychological hit. Unless the liquidity comes back, it will continue to remain the way it is,” Hiranandani said.

[SOURCE:-BLOOMBERG QUINT]