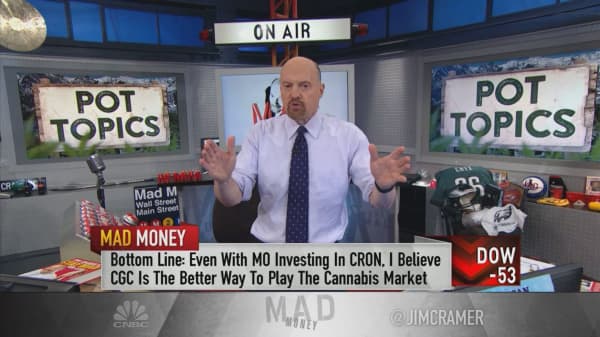

Tobacco giant Altria Group’s investment in cannabis company Cronos Group may have been a smart move for the cigarette maker, but Canopy Growth Corp. remains the best investment in the cannabis space, says CNBC’s Jim Cramer.

“Even with Altria investing in Cronos, I believe that Canopy Growth remains the best way to play the Canadian cannabis market,” Cramer, host of “Mad Money,” said Tuesday.

Altria announced its $1.8 billion investment in Cronos on Friday. The companies cast the deal as mutually beneficial, with Altria getting an edge in Canada’s newly legal cannabis market and Cronos being able to expand more quickly and get ahead of U.S. regulatory hurdles.

But even though some Wall Street analysts embraced the deal, with one calling it a “unique entry into cannabis” for Altria, Cramer said Canopy Growth’s scale gives it a significant advantage over Cronos. Canopy has the added advantage of a multi-billion-dollar infusion from U.S. alcohol producer Constellation Brands, he noted.

“Can Cronos compare to Canopy Growth? Honestly, it isn’t really a fair comparison,” he said. “Canopy’s significantly larger than Cronos — we’re talking about an $11.4 billion company versus a $2.3 billion company. Canopy’s got scale, and scale matters in this business.”

Cramer acknowledged that few companies know “how to market socially stigmatized, heavily regulated, morally dubious products” better than Marlboro parent Altria. But, he said, Canopy Growth is already leading Cronos in 12 out of 13 cannabis product categories, according to Canopy’s founder and co-CEO, Bruce Linton.

“Cronos leads in one out of those 13. That’s because Canopy sells many more types of products: flowers, oil, pre-rolls, soft gels, and vapes. Cronos only sells flowers, oil and pre-rolls,” Cramer said, noting that Canopy already has patents on 137 types of products.

The comparison holds in medicinal marijuana, Cramer continued. Last quarter, Canopy shipped nearly 2,200 kilograms of medicinal product, which equated to about $23.3 million in sales. Cronos shipped 514, which totaled about $3.8 million.

The backers here matter, too, said the “Mad Money” host. Constellation Brands, which has a 38 percent stake in Canopy, has a history of successfully acquiring and growing smaller brands, he said. Better yet, Canopy has been receiving Constellation’s funding for more than a year.

Altria, on the other hand, has struggled to diversify away from its core cigarette business, only reportedly holding talks with market share cannibal Juul this year, Cramer noted, adding that its deal for a 45 percent stake in Cronos won’t close until the first half of 2019.

“To me, it seems like Constellation took its time [and] thoughtfully picked the best player to invest in, whereas Altria’s move feels a little rushed, maybe even intemperate and impulsive,” he said. “When I say Canopy has a head-start, we’re talking about a big lead over the competition.”

As it stands, shares of both Canopy and Cronos are expensive on a price-to-sales basis, but Canopy’s stock, which Cramer regards as the space’s “best player,” still trades at a discount to Cronos, which shouldn’t be happening, he said.

All in all, Cramer preferred Canopy over Cronos, but added that “you could just as easily buy shares in … Constellation Brands, which has a very good revenue stream and fast-growing beer. I think it’s less risky.”

“Now, I don’t mind [buying shares] in Cronos. I don’t,” the “Mad Money” host said. “But Canopy is the better company. Oh, and look for more marijuana buyers, especially liquor companies, because if they don’t jump on the bandwagon, competition from legalized pot is just going to tear into their sales.”

[“source=cnbc”]