Mumbai: Life insurers such as ICICI PrudentialNSE 1.55 %, HDFC LifeNSE 0.25 % and SBI LifeNSE -0.05 % are set for a quarter of strong new business growth driven by increasing margin gains in protection business, expanding distribution network and robust premium even as some insurers may see increased stress in certain portfolios due to a slowing economy.

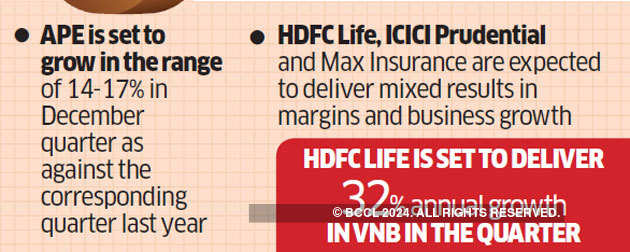

The December quarter, which historically is a strong business quarter for life insurers as agents attempt to complete their year-end targets, will see these players grow their value of new business (VNB) margins in the range of 15-30%. Annualised Premium (APE), an indicator to gauge the business sales in the life insurance industry, is set to grow in the range of 14-17% in the reporting quarter as against the corresponding quarter last year, according to brokerages.

Furthermore, new consumer protection guidelines, announced by the Insurance Development and Regulatory Authority (Irdai) for increased transparency and prevention of mis-selling kicked in from December, could also have egged several of these players to make aggressive sales in the months preceding to the deadline.

“Trends in the third quarter were mixed, with some breather seen in October, followed by a rush toward selling traditional products in November (before Irdai’s new guidelines kicked in) and expectation for a strong December, led by new launches and MDRT agent targets deadline by December,” said Emkay Global’s report. “We expect April to be better given inherent seasonality (contributes 35% of annual volumes) and expected growth across channels,” the report said.

Among life insurers, private players HDFC Life, ICICI Prudential and Max Insurance are expected to deliver mixed results in margins and business growth. According to brokerage Kotak Institutional Equities Research, HDFC Life is set to deliver 32% annual growth in VNB in the quarter which is lower than 57% posted in the first half of the year due to possible moderation in premium sales in this period. “The company has launched a new participating product which will likely have higher margins compared to ULIP and existing participating products; however, this will likely scale up meaningfully in April quarter,” it said.

“The focus for us will be on persistency and growth outlook at ICICI Prudential, traction in new products and group protection at HDFC Life and extent of margin improvement at SBI Life” when the December quarter results are announced by these companies later in the month, Morgan Stanley said in its report.

[“source=clmbtech”]