A quick reminder of the result of September’s election shows why Angela Merkel is in a bind.

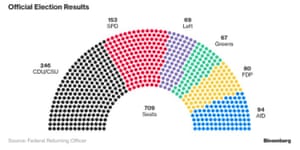

Having only won 246 out of the 706 seats in the Bundestag, the CDU/CSU needs coalition partners to form a stable government.

However, the maths is tricky, as the SPD isn’t willing to join another grand coalition.

That leaves four smaller parties; but ideological disagreements mean a formal deal with either the left-wing Die Linke or the far-right AfD isn’t feasible.

So a deal with the Greens and the the FDP was the only option.

Christian Odendahl of the Centre for European Reform reckons the SPD could help prop up a minority administration.

Here’s a chart of the euro’s sharp moves against the US dollar this morning:

City Index(@CityIndex)

Check out this #EURUSD chart, the Merkel “smile” as the euro brushes off German political uncertainty. pic.twitter.com/YtzXW02z35

November 20, 2017

However, the euro is still down 0.5% against the pound, at €1.125.

10.01am10:01

Table of Contents

ToggleEuro recovers on minority government hopes

A flurry of headlines from Germany are helping the euro to claw back some of its earlier losses.

The Free Democrats have apparently signalled that they could support a minority government made up of the CDU-CSU bloc and the Green party.

FDP parliamentary director Marco Buschmann told the Bild newspaper that:

“If there are good initiatives, then we are available.”

The prospect of Angela Merkel holding onto power seems to be reassuring investors, even though nothing is clear at this stage.

Arne Petimezas(@APetimezas)

FDP floor leader Buschmann tells Bild his party doesn’t want fundamental opposition, but play a constructive role by supporting a minority government https://t.co/YDRiZtOmBz

November 20, 2017

Tom Fairless(@TomFairless)

Germany’s FDP would support a minority Merkel government, Bild reports, citing FDP’s chief whip Marco Buschmann https://t.co/pseRzJfgjI

November 20, 2017

Mike Dolan(@reutersMikeD)

As Merkel seeks Plan B, DAX, euro/$ and 10-yr bund yield recapture early losses. Economics trumps politics again? Or a bet on minority govt? pic.twitter.com/xtIBuFPwGl

November 20, 2017

9.52am09:52

Dutch foreign minister Halbe Zijlstra has warned that the collapse of German coalition talks last night is ‘bad news’ for Europe.

Zijlstra told reporters in Brussels that:

“Germany is a very influential country within the EU so if they don’t have a government and therefore don’t have a mandate it’ll be very hard for them to take positions.”

(thanks to Reuters for the quote)

9.30am09:30

Peter Thal Larsen, European editor at Breakingviews, sums up the situation:

Peter Thal Larsen(@peter_tl)

Mugabe holding onto power and Merkel possibly losing it were headlines I did not expect to wake up to this morning.l

November 20, 2017

9.10am09:10

Political economics professor Henrik Enderlein says Angela Merkel has been “seriously weakened”, with no easy way forward.

Henrik Enderlein(@henrikenderlein)

Implications of 🇩🇪 coalition talk collapse:

– no strong + stable gvt before fall 2018 at the earliest

– minority gvt possible, but untested, unlikely can last for long

– Merkel seriously weakened – end of era near

– leadership gap in 🇪🇺 – all eyes on Macron#JamaicaNovember 20, 2017

Henrik Enderlein(@henrikenderlein)

Cruel for #Merkel: Constitution provides script for internal CDU-CSU coup against her. She must ask Bundestag to elect her Chancellor. Her problem is not she won’t be elected, but number of missing CDU-CDU votes in this anonymous election. Dream moment for her enemies.

November 20, 2017

Henrik Enderlein(@henrikenderlein)

Option 1: Grand Coalition. Highly unlikely as durable solution. Transition to snap elections at best.

Option 2: Minority government tolerated by SPD. See option 1.

Option 3: Snap elections. Difficult right now. Don’t expect them before late spring 2018.

November 20, 2017

9.02am09:02

The possibility that Angela Merkel could be forced out of the German Chancellery will worry the City, says Rebecca O’Keeffe, head of investing at interactive investor.

“European equity markets have picked up where they left off last week, heading lower after the FDP walked out of German coalition talks. Angela Merkel has been the glue that has held the European Union together for the past 12 years, a stable force in turbulent times.

Chancellor Merkel is also one of the few European politicians who has demonstrated she may be prepared to compromise with Britain, rather than run the risk that Prime Minister May is replaced by a hardline Brexiteer. With almost unsurpassed political experience, markets will want Germany to find a quick solution, preferably one that leaves Mrs Merkel in situ.

8.50am08:50

Get up to speed every day with our morning email!

8.50am08:50

Ulrich Speck, senior research fellow of the Elcano Royal Institute think tank, says the collapse of the Jamaica coalition talks could be a major moment in German politics, and beyond.

Ulrich Speck(@ulrichspeck)

With the failure of coalition talks, Germany is entering uncharted waters. We may see just see a (long) delay, with Merkel getting another term. Or we see the reshuffling of German politics that was supposed to come 2021 with the end of the Merkel-type of stability.

November 20, 2017

Ulrich Speck(@ulrichspeck)

It is a mistake to think that if Berlin is unable to act, Paris will play a bigger role in the EU. If Berlin is unable to act, the EU is unable to act as well. Less Germany does not mean more France, it means less joint European action.

November 20, 2017

Ulrich Speck(@ulrichspeck)

“Instability” in Berlin = problem is not what happens, but what doesn’t happen. At a moment when Europe needs strong joint German-French leadership on many issues, Berlin is unable to deliver. Otherwise, even with a caretaker government, there will be continuity.

November 20, 2017

8.49am08:49

The pound is gaining ground against the euro this morning, up 0.25% at €1.1235.

8.44am08:44

Angela Merkel will meet with Germany’s president, Frank-Walter Steinmeier, later today to discuss the situation.

Steinmeier is a leading figure in the left-wing Social Democrat party – who came second in September’s election but refused to enter another Grand Coalition.

Marc Ostwald of ADM Investor Services suspects that a minority government made up of Merkel’s CDU/CSU and the Green party might have decent survival prospects, as the SPD could support much of its legislative programme.

He adds:

As a point of historical note, there is no precedent for fresh general elections so quickly after the previous one. I would not want to second guess this situation, but with Steinmeier being president, and the risk that any or all of the CDU, SPD and FDP take a hammering if fresh elections are held, it might be the compromise outcome.

8.28am08:28

Germany’s DAX stock index has fallen by half a percent at the start of trading in Frankfurt.

Postal operator Deutsche Post, financial group Deutsche Bank and industrial giant Thyssenkrupp are leading the fallers.

But…energy provider RWE have jumped by almost 4%. That’s because German’s Green party would have pushed for coal-fired power plants to be shut down had they joined a coalition.

Other European markets have also dipped into the red.

Lukman Otunuga, research analyst at FXTM, fears that Angela Merkel’s failure to form a new government could drive markets lower.

With this bombshell development heightening concerns over political instability in Europe’s largest economy and sparking speculation of fresh elections, the Euro may be in store for further punishment.

Although Europe’s encouraging macro fundamentals may offer some background support to the Euro long term, political risk has the ability to trigger further selloffs in the shorter term.

8.15am08:15

Germany’s coalition conundrum puts the whole future of Europe into doubt, says Dean Turner of UBS Wealth Management.

He told Bloomberg TV that:

The clear risk is that if Angela Merkel was not going to continue as chancellor, what would that mean for Europe?

With Emmanuel Macron elected in France, the push to rebuild the Franco-German alliance, to restructure Europe and make new reforms would be put into question.

Updated at 10.07am GMT

8.10am08:10

Why German talks failed

The FT’s Tobias Buck has a good explanation of why Merkel and the Free Democrats couldn’t reach a coalition deal.

Among the core differences was the issue of refugee and asylum policy and, in particular, the issue of whether refugees should be allowed to bring their families to Germany.

In 2016, at the height of the Syrian refugee crisis, Berlin suspended that right. But the freeze on family reunifications runs out next year, raising the prospect of a spike in new arrivals.

The Bavarian CSU, the sister party of Ms Merkel’s CDU, was determined to prolong the suspension, broadly backed by the CDU and the FDP. The Greens, in contrast, insisted that refugees must be allowed to bring their spouses and children into the country, citing humanitarian reasons.

Other areas of disagreement were Germany’s response to climate change and the Green demand to shut down a significant number of coal-fired power plants, which are among the biggest producers of carbon dioxide emissions.

Tax policy, too, was a bone of contention, with the FDP demanding a rapid phase-out of the so-called solidarity tax that is raised to fund the economic development in eastern Germany.

Updated at 8.10am GMT

7.59am07:59

Our correspondent in Berlin, Philip Oltermann, says Merkel’s position as Germany’s leader is now under scrutiny, following the collapse of coalition talks.

He writes:

With talks now seemingly over, Merkel could seek to form a minority government, either with the FDP or the Greens, and gather support from other parties on individual policy votes.

The Social Democrat leader, Martin Schulz, whose party has played junior partner to Merkel in the German government for the past four years, ruled out the possibility of another grand coalition under his leadership. “The voter has rejected the grand coalition,” Schulz said at a party conference in Nuremberg on Sunday.

Once all other options are exhausted, Germany’s president, Frank-Walter Steinmeier, could dissolve the current parliament and call fresh elections. To get there, however, Steinmeier would need first to set into motion a complicated process that would involve a parliamentary vote on Merkel’s role as interim chancellor.

While the debate in Germany over the past few weeks has mainly focused on policy differences between the parties, it is likely to soon shift to the chancellor, and the question of whether or not she still commands sufficient power to hold together a strong government.

7.47am07:47

The agenda: German talks collapse; Draghi testifies to MEPs

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Oh Mutti! German politics has been plunged into new uncertainty overnight after Angela Merkel’s attempts to form a new coalition collapsed.

Overnight, the pro-market Free Democratic Party walked out of talks with Merkel’s CDU-CSU group, and the leftwing Green party. Despite weeks of talks, the FDP, the CDU and the Greens weren’t able to carve out an agreement on migration and climate change.

This seems to have scuppered Merkel’s hopes of building a ‘Jamaica coalition’, following September’s election.

Investors are watching with considerable interest to see how Merkel reacts. Will she try to lead a minority government, which could hamper her efforts to push through legislation on issues like refugees policy, or Brexit….

Alternatively, she could push for new elections. But that has risks too — embroiling Germany in a second campaign with no certainty that Merkel’s party would do any better than last time (when her majority fell sharply).

The financial markets have already reacted, sending the euro down almost half a cent against the US dollar to €1.175.

Dennis de Jong, managing director at UFX.com, says the FDP’s decision to quit coalition talks could have a “considerable impact” on European politics, and the markets.

“News emerging from Germany that Angela Merkel has failed to form a coalition within deadline has thrown the country into a state of political disarray for the time being, which could have a detrimental effect on the eurozone as a result.

“Germany is renowned for being the economic powerhouse of Europe in recent times, and has consistently contributed to its growth in the first three quarters of this year. Despite the single currency remaining strong for now and the eurozone stimulus programme going to plan, the ECB may choose to approach the situation in Germany with caution until political matters becomes clearer.

The German stock market is also expected to drop this morning, as traders in Frankfurt brace for more turmoil.

German politics may hog the spotlight today, as there’s not much else in the calendar. ECB president Mario Draghi will give his views on the state of the eurozone after lunch, when he appears before the European Parliament Committee on Economic and Monetary Affairs.

In the UK, we’ll be enjoying the build-up to Philip Hammond’s budget on Wednesday.

SOURCE:-.theguardian