Britain’s services sector enjoyed a record rise last month, as companies shrugged off the initial shock of the vote to leave the EU, according to a survey of business activity that adds to signs the economy has escaped recession in the immediate aftermath of the referendum.

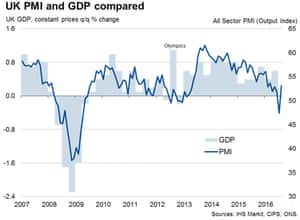

The Markit/CIPS purchasing managers’ index (pdf) for August rose to 52.9 after slumping to 47.4 for July following the vote to leave the EU, well above the 50 mark that indicates growth. That was the biggest month-to-month jump in the survey’s 20-year history and followed the biggest drop on record the previous month when businesses were coming to terms with the outcome of June’s referendum.

Economists had expected August’s survey to rise to 50, indicating that activity has been flat for a sector which makes up almost four-fifths of the UK economy. The services PMI excludes government services and retail but still covers half of the overall services sector. The surprise surge helped push the pound to a seven-week high against the dollar of $1.3375.

The services sector includes hairdressers and restaurants as well as banking and accountancy.

The services report follows news of a similar rebound in the manufacturing sectorand a more modest improvement in the construction sector last week. Taken with signs of a recovery in consumer confidence and high street spending, it will allay fears that economic growth is grinding to a halt after the referendum.

IHS Markit, the compilers of the PMI reports on manufacturing, services and construction said that they suggested the economy will have managed to eke out some growth in the July-to-September quarter that followed the Brexit vote.

“The UK saw business activity rebound from July’s post-referendum decline in August, enjoying the strongest expansion for five months,” said Chris Williamson, chief business economist at IHS Markit.

There was a record rise in the Markit/CIPS all-sector PMI to 53.2 in August, its highest since March, more than reversing the record fall to 47.4 seen in July.

“Assuming further growth is signalled by the September PMI surveys, we expect the economy to have eked out a modest GDP expansion of 0.1% in the third quarter,” said Williamson.

“While there’s clearly been a sharp slowing in the pace of economic growth in the third quarter, the risk of imminent recession has fallen significantly, attributable in part to renewed stimulus from the Bank of England as well as the calming of uncertainty brought about by the swift introduction of the new government.”

The improvement in companies’ new business and output followed an interest rate cut by the Bank of England to a new record low of 0.25% in early August. Businesses also said they had been helped by a weak pound, which fell sharply after the referendum, making UK exports more competitive and attracting foreign tourists to the UK on shopping sprees.

But there was also evidence the weak pound was stoking inflation by raising import costs. The PMI report showed input price inflation accelerated to a 33-month high in August, linked to the weak pound and rising fuel and labour costs. Subsequently, service providers raised their own prices at the sharpest rate since January 2014.

Economists warn that despite a post-referendum bounce in activity, the decision to leave the EU could be felt more acutely once negotiations to leave the bloc begin in earnest. There are also signs that companies are nervous about hiring and investing as they await more clarity on future trading relationships and immigration rules.

The services report showed business confidence, although improving on July’s multi-year low, remained well below its long-run trend.

“Many companies remain cautious about the outlook, suggesting that political and economic uncertainty is likely to prevail in coming months, subduing growth. It therefore remains far too early to say whether August’s upturn is a dead-cat bounce or the start of a sustained post-referendum recovery,” said Williamson.

Other economists also said the August news should be treated with caution.

“Just as the July survey probably overstated the economy’s underlying weakness, the August survey probably overstates its subsequent recovery,” said Scott Bowman at the consultancy Capital Economics.

“We think an average of the July and August surveys paints a more accurate picture of the economy post-Brexit. And this is consistent with quarterly GDP growth of close to zero – in line with our forecast for the third quarter as a whole.”

Bank of England policymakers have already hinted they will cut interest rates again before the end of the year. Few expect another rate reduction at next week’s policy meeting, but many economists predict the monetary policy committee will move rates again in November and take borrowing costs close to zero.

“Today’s improvements are in line with the string of robust economic figures we’ve seen throughout August. But, while there is some reason for optimism today, it’s still too early to conclude that the UK has escaped the Brexit vote unscathed,” said Dean Turner, economist at UBS Wealth Management.

“Now that we’ve seen some resilience in the UK economy, many are questioning whether last month’s monetary policy committee decision was the right one. We believe the Bank of England has taken the correct course of action and expect them to ease further before the year is out.”

[Source:-The Guardian]