Shake-ups are expected when e-commerce giants like Amazon step into the brick-and-mortar world. The lessons learned from these large-scale moves can be applied to local markets on a smaller scale as well, making them valuable lessons in anticipation and corporate economic involvement for buyers, sellers, and agents everywhere.

Much of this anticipation comes from the fact that technology in America’s economy continues to push unexplored frontiers, and it can be hard to predict every ramification. However, as Amazon prepares to launch HQ2, its second physical North American headquarters, the real estate industry can, with a grain of salt, take cues from the first headquarters in Seattle.

Candidates for Amazon’s newest campus range across the continental U.S., with concentrations on the East Coast. In Long Island City, allegedly one of the top contenders, real estate prices are already beginning to rise. Buyers, in addition, are demonstrating interest in getting out in front of the rise in prices: a swelling volume of inquiries is being made into the increasingly valuable properties in the area.

Learning From History

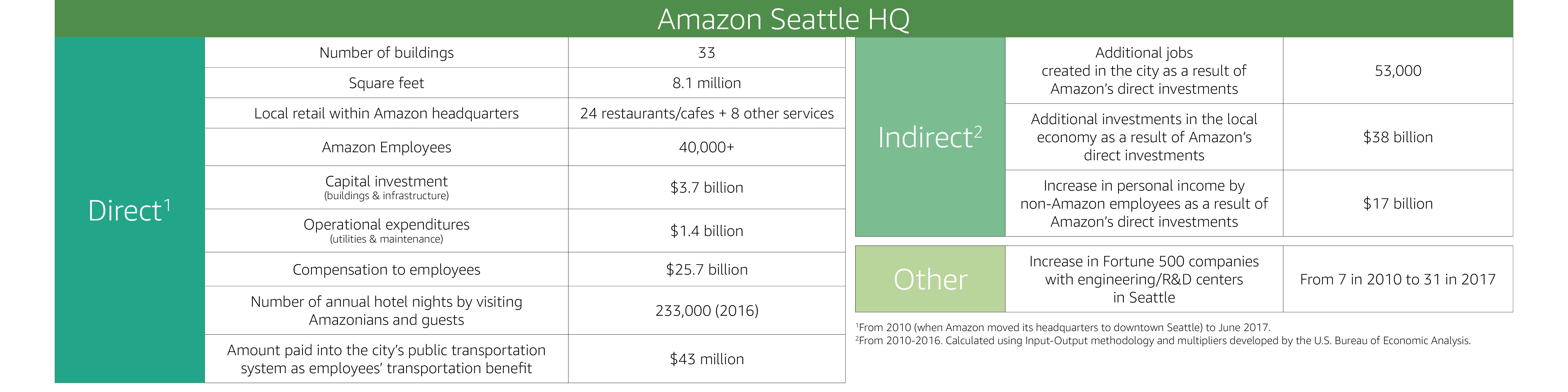

Of course, value is in part an abstract consequence of buyer belief. This optimism is driven by evidence from Amazon’s original headquarters in Seattle. Consumers can derive confidence from the fact that Amazon’s presence had direct and indirect effects on the city’s economy and the labor, transactions, and individuals that comprised it.

via Amazon

The powerhouse invested $3.7 billion in buildings and infrastructures in Seattle. If a similar effect were forecasted for Amazon HQ2, it would paint a picture of bolstered property values and confidence in the viability of the city’s quality of life. Additionally, Amazon HQ’s direct investments in Seattle resulted in 53,000 additional jobs as well as $38 billion in additional investments in the economy and a $17 billion increase in the incomes of non-Amazon employees.

This means that buyers may become more motivated to purchase homes they now see as within the margin of affordability; therefore, however, sellers are likely to rethink their asking prices in light of increased valuation by potential buyers and a boost to the economy overall. This is already beginning to happen in Long Island City, even though no announcement regarding HQ2 has been made.

Practical Applications For Agents

As an agent, understanding the network of these motivations is crucial. It is also essential to frame the reality for clients who are either stymied or a little too inspired by these emerging changes and potentials. One potential outcome is the manifestation of a feedback loop wherein prices respond to increased demand, and buyers are motivated by a market that represents a profitable move for them in the long-term, which in turn results in even higher demand.

Of course, this sort of interaction cannot go on forever, and real estate agents will play a pivotal role in keeping sellers and buyers grounded in the pragmatic moves they can feasibly make in the changing climate. Agents can provide an incredible source of council in uncertain times, and become the key puzzle piece that allows their clients to make informed and beneficial choices.

The balance to be struck between buyers and sellers on this new frontier will likely be mediated in large part by the agents they consult and begin or continue to work with. As an agent, you can caution your clients to be optimistic, but not to ride the euphoria of speculation into a transaction they are not financially prepared for. At the same time, you can apprise them of emerging options and new assets in their communities as companies take footholds in more and more regions great and small.

[“source=realtyleadership”]